The 52-Weeks Savings Challenge: New Year Saving Goals

Whether you’re aiming to save for a vacation, build an emergency fund, or simply create better money habits, one simple and effective way to kickstart your savings journey is the 52-week savings challenge.

Warren Buffett, one of the world’s wealthiest investors, offers a perfect example of how saving regularly can lead to long-term wealth. Buffett grew up in a middle-class family and learned the importance of saving from a young age. He started working as a paperboy at the age of 13 and saved most of his earnings. Instead of spending the money, he invested it in small stocks. By the time he was in his 20s, Buffett had already developed a strong habit of saving and investing wisely. Buffett’s story proves that building wealth isn’t about how much you earn, but how much you save and invest wisely.

What’s the 52-week savings challenge? It’s a popular and easy-to-follow savings plan that encourages you to save a specific amount of money each week for an entire year. By the end of the year, you’ll have saved a total sum that can be used for various financial goals—emergency funds, a rainy-day fund, or even a special purchase or vacation.

In this blog post, we’ll explore how the 52-week savings challenge works, why it’s effective, and how you can make it a part of your New Year’s financial resolutions for 2025. We’ll also share expert tips and actionable steps to ensure you successfully complete the challenge.

How the 52-Week Works

The 52-week savings challenge is a simple but powerful savings plan. Each week of the year, you increase the amount you save, starting with any amount in the first week and adding that same amount each subsequent week. By the end of the 52 weeks, you will have a substantial savings, depending on what you are saving for and the amount saved weekly. Here’s how it works:

- Create a Savings Account: Open a separate savings account specifically for this challenge.

- Save Weekly: Each week, deposit a specific amount of money into your savings account.

- Increase the Amount: The amount you save each week increases by a set amount, it could be $1.

Here’s an example of how the challenge works:

- Week 1: Save $1

- Week 2: Save $2

- Week 3: Save $3

- …

- Week 52: Save $52

By the end of the year, you’ll have saved a total of $1,378.

This method builds your savings progressively, making it easier to stay consistent and motivated as you go. Each week’s contribution seems small, but by the end of the year, you’ll have a nice sum tucked away.

While it may seem like an incremental increase, this type of savings strategy is both practical and manageable. For someone just starting their savings journey, this challenge is an excellent way to form good money habits without feeling overwhelmed.

Why the 52-Week Savings Challenge Works: The Psychology of Saving

Expert insight from financial behaviorist Dr. Brad Klontz explains that small, incremental changes in behavior often lead to long-lasting results. The 52-week savings challenge works because it’s based on the principle of small, manageable goals that compound over time, much like how compound interest works in investments.

The idea of starting with a small weekly savings goal and slowly increasing the amount each week makes it psychologically easier for participants to stay on track. This gradual increase makes saving feel achievable, even for those who may struggle with traditional budgeting or saving strategies. Research by the American Psychological Association (APA) highlights that small wins provide consistent motivation, which is why challenges like this one help build positive financial habits.

In addition, the sense of accomplishment that comes with completing the challenge, can boost your confidence in managing money. This positive reinforcement helps set the stage for future financial goals, whether it’s tackling debt or saving for larger investments.

How to Successfully Complete the 52-Week Savings Challenge in 2025

While the 52-week savings challenge is relatively simple, there are ways to ensure success. Let’s break it down step by step, with expert tips to make it easier to complete the challenge, even when life gets busy or financial surprises arise.

- Automate Your Savings

Financial expert Rachel Cruze emphasizes the importance of automating your savings to avoid the temptation to spend the money. By automating your weekly savings, you can ensure consistency without having to remember to transfer the funds each week.

- Set Up Automatic Transfers: Link your checking account to a separate savings account and set up automatic weekly transfers. For example, you can schedule $1 to be transferred in week 1, $2 in week 2, and so on.

- Use an App: Apps like Qapital to allow you to create automated savings challenges with set goals. These apps will also round up your spare change to contribute toward your savings.

Automating the process not only ensures consistency but also makes the task feel less overwhelming.

- Track Your Progress

One of the best ways to stay motivated is to track your progress. This not only helps you stay on course but also allows you to celebrate small victories along the way.

- Create a Visual Tracker: Design a chart where you can tick off each week as you complete it. You can use a printable version or digital tools like Google Sheets or Trello.

- Share Your Journey: Consider sharing your progress on social media or with a friend or family member. This adds accountability and may inspire others to join the challenge.

Tracking your savings serves as a visual reminder of how far you’ve come and can reignite your motivation when things get tough.

- Be Flexible and Adjust When Needed

While the 52-week savings challenge is about saving a specific amount each week, life doesn’t always go according to plan. There may be times when your financial situation changes due to unexpected expenses or income fluctuations.

**Personal finance coach Shannon McLay recommends that you should feel free to adjust your plan based on your current circumstances, without guilt or shame. For example:

- Double Up on Weeks: If you have a week where you’re unable to contribute the full amount, you can make it up in the following week (for example, save $3 for week 2 if you missed week 1’s $1).

- Skip and Catch Up Later: If you miss a week, it’s okay to skip it and catch up in the next few weeks. The key is staying committed, even if it means altering the timeline.

Remember, consistency is more important than perfection. As long as you stay focused, you’ll reach your savings goal.

- Find Ways to Cut Back on Spending

To make the 52-week challenge more manageable, consider reducing non-essential expenses to free up money for your savings. Personal finance expert Liz Weston suggests small, sustainable changes in spending habits can make a big difference.

- Dining Out: If you typically eat out once or twice a week, consider cutting back by preparing more meals at home. Even saving $20 a week can go toward your weekly challenge savings.

- Subscription Services: Review your subscriptions and cancel those that you don’t need. Consider temporarily pausing services like streaming platforms or gym memberships.

These small changes can help you save more money to meet your weekly goal without feeling deprived.

- Treat Your Savings as a Non-Negotiable

It’s easy to prioritize fun or discretionary spending over savings, but to successfully complete the challenge, consider treating your weekly savings as a non-negotiable expense. Financial expert Jean Chatzky suggests thinking of your savings as a bill that needs to be paid every week, just like rent or utilities.

By making savings a top priority, you are less likely to dip into it for impulse purchases. Additionally, reminding yourself that the savings will pay off in the future can help you stay committed.

Variations of the 52-Week Money Challenge

While the traditional 52-week money challenge is a great way to save, you can also customize it to fit your specific financial goals and lifestyle. Here are a few variations:

- Reverse 52-Week Challenge: Start by saving the highest amount at the beginning and decrease it with each passing week. Example; save $52 in the first week and decrease the amount by $1 each subsequent week.

- Double-Up Challenge: Save double the amount each week, resulting in a larger savings total.

- Half-Year Challenge: Save for 26 weeks instead of 52.

The Benefits of Completing the 52-Week Savings Challenge

The benefits of completing the 52-week savings challenge are more than just financial. Aside from the satisfaction of saving over the course of a year, here are some other perks you can expect:

- Financial Discipline: The challenge encourages you to build a consistent savings habit, which can extend into other areas of your financial life.

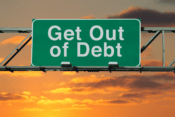

- Emergency Fund: Completing this challenge gives you a nice cushion for unexpected expenses, helping you avoid relying on credit cards or loans in times of need.

- Improved Financial Confidence: By taking small steps each week to improve your savings, you can boost your confidence in managing money and planning for the future.

Additionally, completing the challenge may open doors to setting and achieving larger financial goals, like paying off debt, buying a home, or investing for retirement.

Conclusion: Get Ready to Save in 2025

The 52-week savings challenge is a simple yet powerful way to save money throughout the year. With clear steps, expert advice, and tips for staying on track, you can achieve your savings goal in 2025. Whether you’re saving for an emergency fund, a vacation, or a special occasion, this challenge can set you on the right path toward achieving your financial goals.

By automating your savings, tracking your progress, making adjustments when necessary, and cutting back on spending, you’ll create strong financial habits that will benefit you long after the challenge ends.

Don’t let another year pass without reaching your financial goals. Start the 52-week savings challenge today, and make 2025 your year of financial success!

References:

- “The Psychology of Saving: How Behavioral Science Can Help You Save More Money,” American Psychological Association, 2023.

- “Financial Goals for 2024: How to Build Good Habits,” Rachel Cruze, 2023.

- “How to Build Strong Financial Habits,” Jean Chatzky, 2023.

- “How to Stick to Your Financial Goals,” Shannon McLay, 2023.

- “Why Automating Your Savings Is Essential,” Liz Weston, 2023.